Liberty Mutual Auto Insurance Guide [Everything You Need]

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Johnson

Insurance Lawyer

Jeffrey Johnson is a legal writer with a focus on personal injury. He has worked on personal injury and sovereign immunity litigation in addition to experience in family, estate, and criminal law. He earned a J.D. from the University of Baltimore and has worked in legal offices and non-profits in Maryland, Texas, and North Carolina. He has also earned an MFA in screenwriting from Chapman Univer...

Insurance Lawyer

UPDATED: Dec 27, 2021

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance-related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Dec 27, 2021

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Liberty Mutual Auto Insurance | Details |

|---|---|

| Founded | 1912 |

| Premiums Written | 33,831,726 |

| Loss Ratio | 66.77% |

| Contact Info | Liberty Mutual Insurance 175 Berkeley Street Boston, Massachusetts 02116 Customer Service: 1 (888) 398-8924 Website: https://www.libertymutual.com/ |

| Best For | Automobile, home, and life insurance |

Having recently celebrated its 100th year in operation, Liberty Mutual supports its drivers as one of the largest insurance companies operating in the United States. The company takes its affiliation with American democracy and freedom seriously, taking on the Statue of Liberty not only in their logo but in their commercials.

Even though the company totes these values as essential to its foundation, it can still be difficult to determine whether or not Liberty Mutual is the right provider with you.

Sussing out the value of a car insurance provider takes time and research. If you don’t sit down and compare one provider to another, you’ll never know for sure whether or not you’re making the right financial decision or complying with your state’s laws. That kind of deliberation requires a lot of time and a lot of vigilance.

Why do the work yourself, though, when you could rely on us to do it for you? Here we’ve gathered all of the information you’ll need on Liberty Mutual’s financial history, car insurance availability, and business model.

Walk with us through this guide to Liberty Mutual car insurance, and you’ll be able to decide for yourself whether or not partnering with this provider is the right decision for you.

Want to dig into car insurance rate comparison? You can use our FREE online tool to compare rates in your area.

For now, though, let’s dive into the details of Liberty Mutual’s operations.

Ratings

A number of different agencies, including A.M. Best and J.D. Power, rate insurance companies for their financial strength while also comparing the strength of individual companies against their peers.

By assessing Liberty Mutual’s ratings as assigned by these agencies, you can get a better idea of how Liberty Mutual stacks up against the other insurance providers you have the potential to work with.

| Agency | Rating |

|---|---|

| AM Best | A |

| Better Business Bureau (California) | A- |

| Moody's | Baa2 |

| S&P | BBB |

| Complaint Index | 21.78 |

| Consumer Reports | Very Good |

| Market Share | $5,295.55 |

Let’s break these ratings down.

A.M. Best

A.M. Best awards Liberty Mutual an “A,” or a rating of excellent for its financial standing. This rating indicates that Liberty Mutual has a satisfactory loss ratio.

Loss ratios reflect the number of claims that an insurance provider issues over the course of a fiscal year. A low loss ratio indicates that a company doesn’t pay out as many claims as it could, while a high loss ratio indicates that a company may overpay on its claims and that it’s at risk of going bankrupt.

Liberty Mutual’s loss ratio comes in at 66.77 percent, which isn’t as stellar as it could be, but which certainly isn’t a ratio to sniff at.

Better Business Bureau

Better Business Bureau bases their ratings on a variety of factors, including the number of complaints a provider’s received over the year, how long it’s been in operation, and its loss ratios. Better Business Bureau’s rating system also varies from state to state, making it difficult to provide anyone with a consistent understanding of each of the organization’s rating systems.

That said, in the state of Florida, Liberty Mutual garners an A- rating with Better Business Bureau. While this isn’t an A+, this A- indicates that Liberty Mutual is a completely respectable insurance provider that’s capable of supporting its consumers.

Moody’s Rating

Here’s where things begin to shift. Moody awards Liberty Mutual a Baa2 rating on their scale, where the highest rating a company can receive is an Aaa. Moody bases its ratings on the credit risk that its assessed companies carry.

What does this mean for Liberty Mutual? While the lower rating isn’t a bad thing, it does suggest that Liberty Mutual has marginal credit risk and that investors may face losses if they partner with the company.

S&P

Let’s take a look at one last rating. S&P awards Liberty Mutual a BBB on a scale that, as you may have guessed, goes all the way up to AAA.

What does this medium-grade rating mean? Because S&P bases its ratings on a company’s ability to meet its financial responsibilities, a BBB rating means that Liberty Mutual can meet its financial responsibilities but may face difficulty in doing so due to economic conditions.

All in all, these ratings indicate that Liberty Mutual is a reliable, if middle-of-the-road, insurance provider that drivers can rely on.

NAIC Complaint Index

But let’s dig into some dirt. What does Liberty Mutual’s complaint index look like?

| Company Branch | 2018 Complaint Index |

|---|---|

| Liberty Mutual Fire Insurance Company | 1.67 |

| Liberty Mutual Insurance Company | 21.78 |

| Liberty Mutual Mid Atlantic Insurance Company | 0.0 |

| Liberty Mutual Personal Insurance Company | 0.0 |

Because Liberty Mutual is a larger car insurance provider, it’s natural that the company would see more complaints than other businesses over the course of a fiscal year. However, complaints are a strong indication of how well a company can address the needs of its consumers.

Liberty Mutual, according to NAIC, has a low complaint index. This bodes well for anyone who runs up against trouble insuring their car.

J.D. Power

J.D. Power looks at a company’s overarching responsibility to its consumers from a variety of perspectives. You can see how that assessment breaks down below:

| Rating Factor | Score (out of 5 possible points) |

|---|---|

| Overall Satisfaction | 2 |

| First Notice of Loss | 3 |

| Estimation Process | 3 |

| Repair Process | 3 |

| Rental Experience | 2 |

| Claims Servicing | 2 |

| Settlement | 3 |

Liberty Mutual, in the eyes of J.D. Power, has some room to grow. In fact, J.D. Power places Liberty Mutual near the bottom of its list of reliable insurance providers, especially in the realm of customer service.

This doesn’t mean that the company necessarily struggles in that area. Rather, it means that J.D. Power believes that other insurance providers are able to respond to their customer service needs more effectively than Liberty Mutual.

Consumer Reports

Comparatively, Consumer Reports gives Liberty Mutual an overwhelmingly positive customer satisfaction assessment.

| Claim Process | Satisfaction Rating |

|---|---|

| Ease of Reaching an Agent | Very Good |

| Simplicity of the Process | Very Good |

| Promptness of the Response | Very Good |

| Damage Amount | Very Good |

| Agent Courtesy | Very Good |

| Timely Payment | Very Good |

| Freedom to Select | Very Good |

| Being Kept Informed of Claim Status | Very Good |

Clearly, while the ratings Liberty Mutual receives are important to consider, you should also keep the process with which these ratings are awarded in mind when assessing the meanings of the awarded numbers.

FREE Car Insurance Comparison

Compare quotes from the top car insurance companies and save!

Secured with SHA-256 Encryption

Liberty Mutual History

So, you’ve got Liberty Mutual’s current financial ratings and customer satisfaction figures under your belt. What does the history of the company look like, though?

Understanding how a company came to be, its financial trends, and its goals for the future can all help you determine whether or not it’s the right insurance provider for you.

Market Share

A company’s market shares indicate how effectively the company can build its revenue. Growth indicates that the company is making more money and is, as a result, able to offer its consumers more resources. A decline in market share indicates that the company in question may have fallen on difficult financial times.

| Year | Market Share |

|---|---|

| 2015 | 4.83 % |

| 2016 | 4.97 % |

| 2017 | 5.01 % |

Liberty Mutual’s market share has been slowly creeping upward over the past few years. This growth means that the company can operate more competitively in the insurance market.

Business Model

Liberty Mutual doesn’t prescribe to a single business model. Instead, you’ll be able to purchase an insurance policy with the company courtesy of a local agent, an online form, or a phone call.

Agents that work for Liberty Mutual sell independently. This means that they are able to sell Liberty Mutual products as well as products from other companies.

Put another way, Liberty Mutual’s agents aren’t “captive” agents, but rather independent ones. They’ll be able to offer you less biased information about various available providers, as a result.

Even so, if you prefer not to visit an agent in person, you’ll be able to purchase coverage through Liberty Mutual via the phone or an online account.

Advertising

Liberty Mutual relies on its affiliation with the Statue of Liberty to familiarize potential consumers with its brand. As a result, the company doesn’t have a standard mascot, like Geico, or a memorable catchphrase. Instead, the company encourages drivers to “Only Pay For What You Need.”

https://www.youtube.com/watch?v=jpWXpRy_6oI

That said, the company has recently introduced its Limu Emu to its commercials, suggesting that the company’s marketing team has taken on a new advertising angle.

https://www.youtube.com/watch?v=SFu0Pmv-_KU

Investment in the Community

Liberty Mutual established the Liberty Mutual Foundation in 2003 with the intention of providing grants to three of the communities it serves. The Liberty Mutual Foundation – and its partner fund, the Safeco Insurance Fund – supports:

- Accessibility programs for the disabled

- Enrichment and education programs for underprivileged families

- Homelessness programs

The company has, at this point, donated over $52 million dollars to these and other similar causes.

The company also supports its Liberty Torchbearers Program. This program aims to help employees donate their time to their local communities while also matching the donations that individual employees give to the Liberty Mutual Foundation’s causes.

As of 2017, Liberty Mutual’s employees racked up a total of 2,680,844 hours of voluntary community service.

Liberty Mutual’s Position for the Future

Based on its financial ratings and history, Liberty Mutual seems set to remain stable over the next few years, while also seeing a little bit of market share growth. So long as the company maintains its reasonable loss ratio, that growth is more than achievable.

States of Operation

Liberty Mutual’s car insurance policies are available in all 50 states.

Coverage Offered

You’ve seen the ratings, and you’ve got a strong sense of Liberty Mutual’s history as an insurance provider. When you’re looking for a provider, though, you want to know what kind of coverage they can offer you. It’s coverage, after all, that determines how much you will – or won’t – have to pay in the case of an accident.

Let’s break down Liberty Mutual’s available coverage options.

For basic coverage, you can choose from the following:

- Bodily Injury Liability – if you’re found to be at-fault in an accident, then bodily injury liability insurance will make sure that you can pay for the other injured party’s medical bills.

- Property Damage – once again, if you’re found to be the party responsible for property damage in an accident, then property damage insurance will help you pay to replace the other party’s damaged property.

- Med Pay – medical payment coverage protects you and your passengers in case of injury in an accident. Note that this coverage will help you pay for initial medical treatment costs, including the cost of an ambulance ride, emergency room coverage, and so on. After these initial medical treatments, you’ll need an alternative form of insurance to help you stay in the medical black.

Even though they emphasize the “Only Pay for What You Need” mentality, Liberty Mutual also offers additional coverage plans and add-ons, such as the following:

- Accident Forgiveness – this coverage ensures that your rates won’t rise after your first accident.

- Better Car Replacement – if you happen to total your car, this coverage will help you replace your old car with a car that’s one model year newer and that has fewer than 15,000 miles on the odometer.

- Comprehensive – if your car happens to be damaged by a force of nature (storms, floods, fires, vandalism, or theft), then comprehensive coverage through Liberty Mutual ensures that you’ll be able to afford your repairs or vehicular replacements.

- Collision – if you run into another object, be it a car, mailbox, or something else, this coverage will help you attend to replacement or repair costs.

- Lifetime Repair Guarantee – after an accident, Liberty Mutual will cover the cost of your repairs, save for their deductibles. Do note, though, that you’ll have to take your car to a shop that’s been approved by the insurance provider to receive this coverage.

- New Car Replacement – while this type of coverage is comparable to better car replacement, Liberty Mutual will instead help you find an entirely new car (one from the present model year) to replace the car that you totaled.

- Original Parts Replacement – if you need individual parts for your car, this coverage will ensure that you get some of the newest, original manufacturer parts available. If those original manufacturer parts aren’t available, then Liberty Mutual will direct you to parts that are equal in quality.

- Rental Car Coverage – if you need to rent a vehicle while yours is being repaired, Liberty Mutual will help you cover the cost of that rental.

- Ridesharing – you absolutely need insurance if you’re using your car for a ridesharing or delivery service. Liberty Mutual does not provide ridesharing insurance, as its insurance can only be used when you are driving for personal reasons.

- Towing and Labor – much like AAA, Liberty Mutual will send a representative from a towing and labor company to come and help you if you happen to get in an accident on the side of the road.

- Uninsured Motorist Coverage – if you happen to get into an accident with another driver who is under- or uninsured, then this coverage will ensure that they won’t go bankrupt paying off your medical bills or property damage.

Liberty Mutual’s Discounts

Liberty Mutual encourages its drivers to only purchase as much car insurance coverage as they truly need. In line with this money-conscious attitude, the company offers a variety of discounts to qualified drivers. You can peruse these different discounts and the percentage of subsequent savings in the table below:

| Discount | % Savings |

|---|---|

| Adaptive Cruise Control | 5% |

| Adaptive Headlights | 5% |

| Anti-Lock Brakes | 5% |

| Anti-Theft | 20% (off of comprehensive policy) |

| Daytime Running Lights | 5% |

| Defensive Driver (usually must be 50-years-old or older) | 10% |

| Driver's Ed | 10% |

| Right Track | up to 30% |

| Electronic Stability Control | 5% |

| Federal Employee | 10% |

| Forward Collision Warning | 5% |

| Full Payment | $5 off on monthly processing fee |

| Further Education | 10% |

| Good Student | 22.5% |

| Green (Eco-Friendly, Hybrid) Vehicle | 10% |

| Membership/Group | 10% |

| Military | 4% |

| Multiple Policies | 20% |

| Multiple Vehicles | 10% |

| New Address | 5% |

| New Graduate | 5% |

| Newly Licensed | 5% |

| Newlyweds | 5% |

| Occupation | 10% |

| Recent Retirees | 4% |

| Students and Alumni | 10% |

| Switching Provider | 10% |

| Vehicle Recovery | 35% |

| VIN Etching | 5% |

Even though there are a number of discounts listed here, Liberty Mutual is missing some discounts that other insurance providers consider essential. These discounts include:

- Continuous Coverage

- Discount Student

- Early Signing

- Emergency Deployment

- Engaged Couple

- Family Legacy

- Family Plan

- Farm Vehicle

- Fast 5

- Garage/Storing

- Good Credit

- Life Insurance

- Loyalty

- Military Garaging

- Multiple Drivers

- New Vehicle

- Non-Smoker/Non-Drinker

- Occasional Operator

- On-Time Payments

- Online Shopper

- Paperless Documents

- Renter

- Roadside Assistance

- Safe Driver

- Seat Belt Use

- Senior Driver

- Stable Residence

- Utility Vehicle

- Volunteer

That may seem like a significant number of missing discounts. However, Liberty Mutual offers 38 discounts in total, which is fairly standard for car insurance providers of its standing. Even so, keep these available and missing discounts in mind while planning your car insurance budget.

Compare quotes from the top car insurance companies and save! Secured with SHA-256 Encryption

Availability of Coverage

From here, we can get down to brass tax. How does Liberty Mutual stack up against its peers in terms of the cost of coverage?

No one wants to spend more than they need to on coverage. That said, your coverage costs will vary based on your demographic, driving record, coverage level, credit history, commute, and the make and model of your car. Because Liberty Mutual’s rates also vary by state, your location will also contribute to your annual costs.

Take a peek below and see for yourself how Liberty Mutual’s rates might vary for you.

Liberty Mutual’s Available State Rates

| State | Annual Premium | Average Compared to State Average | Percentage Compared to State Average |

|---|---|---|---|

| Alaska | $5,295.55 | $1,874.04 | 35.39% |

| Alabama | $4,005.48 | $438.52 | 10.95% |

| Arkansas | Data Not Available | Data Not Available | Data Not Available |

| Arizona | Data Not Available | Data Not Available | Data Not Available |

| California | $3,034.42 | -$654.51 | -21.57% |

| Colorado | $2,797.74 | -$1,078.65 | -38.55% |

| Connecticut | $7,282.87 | $2,663.95 | 36.58% |

| District of Columbia | Data Not Available | Data Not Available | Data Not Available |

| Delaware | $18,360.02 | $12,373.69 | 67.39% |

| Florida | $5,368.15 | $687.69 | 12.81% |

| Georgia | $10,053.44 | $5,086.61 | 50.60% |

| Hawaii | $3,189.55 | $633.91 | 19.87% |

| Iowa | $4,415.28 | $1,434.00 | 32.48% |

| Idaho | $2,301.51 | -$677.58 | -29.44% |

| Illinois | $2,277.65 | -$1,027.83 | -45.13% |

| Indiana | $5,781.35 | $2,366.38 | 40.93% |

| Kansas | $4,784.42 | $1,504.80 | 31.45% |

| Kentucky | $5,930.97 | $735.57 | 12.40% |

| Louisiana | Data Not Available | Data Not Available | Data Not Available |

| Maine | $4,331.39 | $1,378.12 | 31.82% |

| Maryland | $9,297.55 | $4,714.85 | 50.71% |

| Massachusetts | $4,339.35 | $1,660.50 | 38.27% |

| Michigan | $20,000.04 | $9,501.40 | 47.51% |

| Minnesota | $13,563.61 | $9,160.36 | 67.54% |

| Missouri | $4,518.67 | $1,189.74 | 26.33% |

| Mississippi | $4,455.94 | $791.37 | 17.76% |

| Montana | $1,326.11 | -$1,894.73 | -142.88% |

| North Carolina | $2,182.71 | -$1,210.40 | -55.45% |

| North Dakota | $12,852.83 | $8,686.99 | 67.59% |

| Nebraska | $6,241.52 | $2,957.84 | 47.39% |

| New Hampshire | $8,444.41 | $5,292.64 | 62.68% |

| New Jersey | $6,766.62 | $1,251.40 | 18.49% |

| New Mexico | Data Not Available | Data Not Available | Data Not Available |

| Nevada | $6,201.55 | $1,339.85 | 21.61% |

| New York | $6,540.73 | $2,250.85 | 34.41% |

| Ohio | $4,429.74 | $1,720.03 | 38.83% |

| Oklahoma | $6,874.62 | $2,732.30 | 39.74% |

| Oregon | $4,334.55 | $866.78 | 20.00% |

| Pennsylvania | $6,055.20 | $2,020.70 | 33.37% |

| Rhode Island | $6,184.12 | $1,180.76 | 19.09% |

| South Carolina | Data Not Available | Data Not Available | Data Not Available |

| South Dakota | $7,515.99 | $3,533.72 | 47.02% |

| Tennessee | $6,206.69 | $2,545.80 | 41.02% |

| Texas | Data Not Available | Data Not Available | Data Not Available |

| Utah | $4,327.76 | $715.87 | 16.54% |

| Virginia | Data Not Available | Data Not Available | Data Not Available |

| Vermont | $3,621.08 | $386.95 | 10.69% |

| Washington | $3,994.73 | $935.41 | 23.42% |

| West Virginia | $2,924.39 | $329.03 | 11.25% |

| Wisconsin | $6,758.85 | $3,152.79 | 46.65% |

| Wyoming | $1,989.36 | -$1,210.72 | -60.86% |

| Median | $5,295.55 | $1,634.66 | 30.87% |

Don’t let the cost of your car insurance be the sole reason you choose to move, but you should be aware that the rate you’re charged will vary based on the state you’re in. The minimum required liability insurance you’re required to have will also vary by state, so make sure you do your research before purchasing your coverage.

Average Annual Premium in Comparison

| Company | Average Annual Premium |

|---|---|

| Liberty Mutual | $6,073 |

| Allstate | $4,887 |

| Travelers | $4,434 |

| Farmers | $4,194 |

| Progressive | $4,035 |

| American Family | $3,493 |

| Nationwide | $3,450 |

| State Farm | $3,260 |

| Geico | $3,215 |

| USAA | $2,537 |

No matter what your state, Liberty Mutual does have an average annual premium that’s significantly more expensive than that of its insurance providing peers.

Average Annual Premium by Demographic

It’s a commonly held belief that men pay more for their car insurance than women do. As a matter of fact, this is a car insurance myth.

| Provider | Single 17-year-old Female | Single 17-year-old Male | Single 25-year-old Female | Single 25-year-old Male | Married 35-year-old Female | Married 35-year-old Male | Married 60-year-old Female | Married 60-year-old Male |

|---|---|---|---|---|---|---|---|---|

| Allstate | $9,282.19 | $10,642.53 | $3,424.87 | $3,570.93 | $3,156.09 | $3,123.01 | $2,913.37 | $2,990.64 |

| American Family | $5,996.50 | $8,130.50 | $2,288.65 | $2,694.72 | $2,202.70 | $2,224.31 | $1,992.92 | $2,014.38 |

| Farmers | $8,521.97 | $9,144.04 | $2,946.80 | $3,041.44 | $2,556.98 | $2,557.75 | $2,336.80 | $2,448.39 |

| Geico | $5,653.55 | $6,278.96 | $2,378.89 | $2,262.87 | $2,302.89 | $2,312.38 | $2,247.06 | $2,283.45 |

| Liberty Mutual | $11,621.01 | $13,718.69 | $3,959.67 | $4,503.13 | $3,802.77 | $3,856.84 | $3,445.00 | $3,680.53 |

| Nationwide | $5,756.37 | $7,175.31 | $2,686.48 | $2,889.04 | $2,360.49 | $2,387.43 | $2,130.26 | $2,214.62 |

| Progressive | $8,689.95 | $9,625.49 | $2,697.73 | $2,758.66 | $2,296.90 | $2,175.27 | $1,991.49 | $2,048.63 |

| State Farm | $5,953.88 | $7,324.34 | $2,335.96 | $2,554.56 | $2,081.72 | $2,081.72 | $1,873.89 | $1,873.89 |

| Travelers | $9,307.32 | $12,850.91 | $2,325.25 | $2,491.21 | $2,178.66 | $2,199.51 | $2,051.98 | $2,074.41 |

| USAA | $4,807.54 | $5,385.61 | $1,988.52 | $2,126.14 | $1,551.43 | $1,540.32 | $1,449.85 | $1,448.98 |

Age has a much more significant impact on your insurance rate than gender does – unless you’re a teenage boy learning to drive for the first time. Teenagers will have to spend more on their car insurance than older, married drivers simply due to their lack of experience on the road.

Annual Average Premium by Coverage Level

Naturally, the amount of coverage you opt to take on will impact your average annual rate, as you can see below.

| Coverage Level | Average Liberty Mutual Rate |

|---|---|

| Low | $5,805.75 |

| Medium | $6,058.57 |

| High | $6,356.04 |

Average Annual Premium by Driving Record

If you have points on your license or a history of accidents on the road, then you might see your car insurance rates rising, even if you’re switching companies.

| Group | Clean record | With 1 accident | With 1 DUI | With 1 speeding violation |

|---|---|---|---|---|

| Allstate | $3,819.90 | $4,987.68 | $6,260.73 | $4,483.51 |

| American Family | $2,693.61 | $3,722.75 | $4,330.24 | $3,025.74 |

| Farmers | $3,460.60 | $4,518.73 | $4,718.75 | $4,079.01 |

| Geico | $2,145.96 | $3,192.77 | $4,875.87 | $2,645.43 |

| Liberty Mutual | $4,774.30 | $6,204.78 | $7,613.48 | $5,701.26 |

| Nationwide | $2,746.18 | $3,396.95 | $4,543.20 | $3,113.68 |

| Progressive | $3,393.09 | $4,777.04 | $3,969.65 | $4,002.28 |

| State Farm | $2,821.18 | $3,396.01 | $3,636.80 | $3,186.01 |

| Travelers | $3,447.69 | $4,289.74 | $5,741.40 | $4,260.80 |

| USAA | $1,933.68 | $2,516.24 | $3,506.03 | $2,193.25 |

Note that Liberty Mutual sees the biggest jump in cost if you happen to have a DUI on your record. This is just one reason, of course, that you’ll want to avoid drinking and driving, but it is a significantly expensive one.

Average Annual Premium by Credit History

Your credit history reflects your ability to pay back money that you owe to a particular organization. Naturally, car insurance providers will take your credit history into account when choosing how much to charge you for your annual rate.

| Group | Good | Fair | Poor |

|---|---|---|---|

| Allstate | $3,859.66 | $4,581.16 | $6,490.65 |

| American Family | $2,691.74 | $3,169.53 | $4,467.98 |

| Farmers | $3,677.12 | $3,899.41 | $4,864.14 |

| Geico | $2,434.82 | $2,986.79 | $4,259.50 |

| Liberty Mutual | $4,388.18 | $5,604.24 | $8,802.22 |

| Nationwide | $2,925.94 | $3,254.83 | $4,083.29 |

| Progressive | $3,628.85 | $3,956.31 | $4,737.64 |

| State Farm | $2,174.26 | $2,853.00 | $4,951.20 |

| Travelers | $4,058.97 | $4,344.10 | $5,160.22 |

| USAA | $1,821.20 | $2,219.83 | $3,690.73 |

As you can see, the range between Liberty Mutual’s average costs for drivers with good credit and poor credit is over $4,000. This is a cost you’ll want to keep in mind when considering whether or not Liberty Mutual is the right provider for you.

Average Annual Premium by Commute

Some companies will also vary the amount they charge you based on your annual commute.

| Group | 10 miles commute. 6000 annual mileage. | 25 miles commute. 12000 annual mileage. |

|---|---|---|

| Allstate | $4,841.71 | $4,934.20 |

| American Family | $3,401.30 | $3,484.88 |

| Farmers | $4,179.32 | $4,209.22 |

| Geico | $3,162.64 | $3,267.37 |

| Liberty Mutual | $5,995.27 | $6,151.63 |

| Nationwide | $3,437.33 | $3,462.67 |

| Progressive | $4,030.02 | $4,041.01 |

| State Farm | $3,175.98 | $3,344.01 |

| Travelers | $4,399.85 | $4,469.96 |

| USAA | $2,482.69 | $2,591.91 |

Liberty Mutual’s range isn’t so severe, but you will have to pay more for your coverage if you happen to drive 12,000 miles or more per year.

Average Annual Premium by Make and Model

Finally, the type of car and its year of product will vary your rate. Newer cars, as you might expect, come with higher annual insurance costs.

| Group | 2015 Ford F-150: Lariat SuperCab with 2WD 6.5 foot bed and 2.7L V6 | 2015 Honda Civic Sedan: LX with 2.0L 4cyl and CVT | 2015 Toyota RAV4: XLE | 2018 Ford F-150: Lariat SuperCab with 2WD 6.5 foot bed and 2.7L V6 | 2018 Honda Civic Sedan: LX with 2.0L 4cyl and CVT |

|---|---|---|---|---|---|

| Allstate | $4,429.74 | $4,753.69 | $4,324.99 | $5,491.12 | $5,380.28 |

| American Family | $3,447.30 | $3,178.82 | $3,326.18 | $3,487.91 | $3,721.32 |

| Farmers | $4,093.50 | $4,405.21 | $3,728.22 | $4,390.19 | $4,779.51 |

| Geico | $3,092.11 | $3,092.58 | $3,090.89 | $3,338.40 | $3,338.87 |

| Liberty Mutual | $5,830.16 | $5,869.32 | $5,825.33 | $5,988.85 | $6,682.63 |

| Nationwide | $3,571.01 | $3,547.84 | $3,517.03 | $3,373.64 | $3,361.93 |

| Progressive | $3,914.05 | $4,429.56 | $3,647.22 | $3,962.58 | $4,528.90 |

| State Farm | $3,204.23 | $3,024.24 | $3,226.02 | $3,497.17 | $3,189.99 |

| Travelers | $4,023.47 | $4,420.37 | $4,383.78 | $4,412.42 | $4,661.22 |

| USAA | $2,551.56 | $2,409.67 | $2,454.58 | $2,855.69 | $2,422.66 |

Liberty Mutual, in this case, remains reasonably consistent in its pricing, though there is a distinct shift in coverage costs based on the make of the car you insure with the company.

FREE Car Insurance Comparison

Compare quotes from the top car insurance companies and save!

Secured with SHA-256 Encryption

How to File a Claim

If you’ve been in an accident, you’ll need to quickly file a claim to receive the money that your car insurance provider owes you. Liberty Mutual offers you a number of avenues through which to do so, including:

– By phone, calling 1-844-825-2467

– By mobile app, available for Android and iPhone

– By online claim form

Do note that you’ll need the following materials to file your claim with Liberty Mutual:

| Paperwork Needed | Details |

|---|---|

| Driver's License | Required |

| Social Security Number | Required |

| Vehicle Information (VIN number) | Required |

| Bank Documents | Credit score MAY be required |

Website Structure

Liberty Mutual’s website is pretty easy to use. You’ll be able to find all the information you need on your preferred coverage without having to dig too deep into the site’s structure. You’ll also be able to access information about products, services, quotes, claims, and the company itself with ease.

Additional platform features include:

- “Master This,” a guide to basic car repair and choosing a mechanic

- Calculators to help you determine how much coverage you need

- A lengthy resource section that provides information not only on coverage types but on daily car maintenance

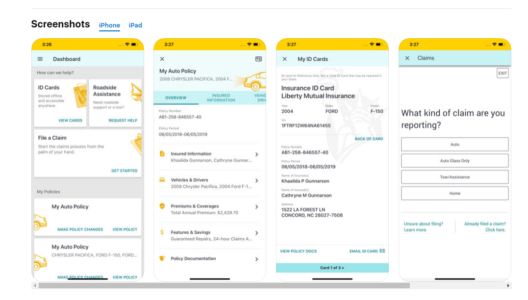

App Structure

You’ll be able to access the Liberty Mutual app on iPhones, iPads, and any Android devices. The available features will not vary based on the platform you’ve chosen to use.

When you take advantage of the Liberty Mutual app, you’ll be able to:

- Pay your related bills

- View your policy and ID cards

- Update your information

- Apply for paperless billing

- Report a claim

- Assess the status of a claim

- Apply to receive text messages about your claim’s status

- Locate approved repair shops

- Take photos after a car accident

FREE Car Insurance Comparison

Compare quotes from the top car insurance companies and save!

Secured with SHA-256 Encryption

Pros and Cons

With all of that in mind, how does Liberty Mutual stack up as an insurance provider?

| Pros | Cons |

|---|---|

| Offers service in U.S. states and globally | Average rates are more expensive than other insurance companies |

| Consumer reports are mostly positive | Loss ratio is a little low |

| Website and app are easy to navigate | Moody's and S&P's ratings could be better |

Liberty Mutual is a growing company. It has a fair number of discounts available to its drivers, and you’ll be able to talk frankly with one of the company’s agents to be sure that you’re getting a fair price. That said, its customer satisfaction ratings could use some work, and it is missing some discounts that other providers consider essential.

Even so, given the market share the company has, it seems as though big things await in Liberty Mutual’s future. This provider may well be the right one for you.

FAQ’s

Do you still have questions about Liberty Mutual’s insurance? We answer some of them here, but you’ll be able to find even more on Liberty Mutual’s FAQ page.

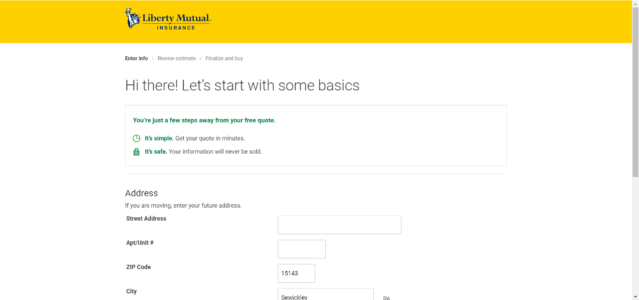

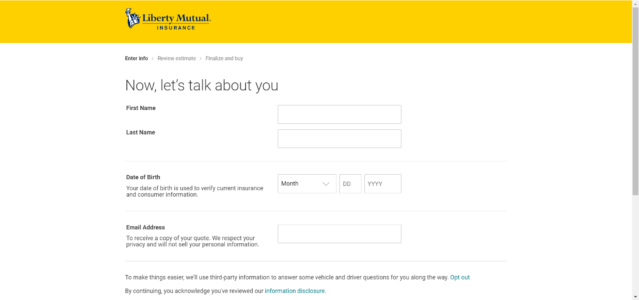

How do I get an auto quote?

You can receive a quote from Liberty Mutual online. Just do as follows:

- On Liberty Mutual’s home page, select the type of quote you’re interested in

- Enter your zip code into the prompted box

- Provide your home address, name, date of birth, and preferred email address

- Liberty Mutual will identify vehicles registered to your name and fill in that information; choose the vehicle you’re looking to insure or add your chosen vehicle manually

- List the names of drivers you want included on your coverage

- Provide Liberty Mutual with a phone number at which you can be reached

- Answer a series of basic questions about your previous insurance policies

- Adjust deductibles and coverage options to your preferred protection level

What is GAP insurance?

GAP insurance is an optional form of car insurance coverage that can help you cover the “gap” between the amount you owe on your car and the amount the car is actually worth, or its actual cash value (ACV).

Should you get in an accident, you’ll be able to use GAP insurance to cover the difference between the amount of money your car is worth now that it’s been damaged and the amount of money you may still owe on an auto loan.

What is an SR-22?

An SR-22 is a certificate of insurance or a form of financial responsibility. This vehicle liability insurance document is only required of drivers who insurance companies like Geico consider to be “high-risk.”

You’ll be considered a high-risk driver if you have an abnormal number of points registered to your driver’s license or if any of the following apply to you:

- You’ve been convicted of a traffic-related offense, like a DUI

- You’ve been in an uninsured car accident and had your license revoked

- You’ve had your license revoked for any other reason

What happens if I’m involved in an accident in another state?

Because Liberty Mutual operates in nearly every state, you should be able to maintain your coverage no matter where you are. However, the nature of individual accidents and state laws may change whether or not you’re determined to be at-fault for an accident or not.

Even so, Liberty Mutual’s liability rates will – in the case of an accident – be modified to match the state minimum liability requirements of the state you got in an accident in. This change will not be a permanent one but will rather only apply to you for as long as a case regarding the accident is ongoing.

Does my deductible still apply even if I’m not at fault?

You may have to pay your deductible even if you’re not at fault depending on what kind of coverage you have. If there’s a chance that Liberty Mutual could recover the amount you paid on your deductible from the person determined to be at-fault in your accident, then the company will do so.

However, if the company does not succeed, you can either choose to try and recover the deductible yourself or pay your deductible as required.

And with that, we’ve come to the end of our guide to Liberty Mutual and their available auto insurance. Liberty Mutual is, overall, a reasonably steady company to partner with.

The company seems primed for growth in the future, so long as it can get a handle on its customer service needs and, subsequently, its ratings. If you’re looking for affordable, easy-to-access coverage, then Liberty Mutual just may be the right provider for you.

If you want to get started comparing rates in your area, why not take advantage of our FREE online tool? Enter your zip code and start comparing the car insurance rates available in your area.

FREE Car Insurance Comparison

Compare quotes from the top car insurance companies and save!

Secured with SHA-256 Encryption

Jeffrey Johnson

Insurance Lawyer

Jeffrey Johnson is a legal writer with a focus on personal injury. He has worked on personal injury and sovereign immunity litigation in addition to experience in family, estate, and criminal law. He earned a J.D. from the University of Baltimore and has worked in legal offices and non-profits in Maryland, Texas, and North Carolina. He has also earned an MFA in screenwriting from Chapman Univer...

Insurance Lawyer

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance-related. We update our site regularly, and all content is reviewed by auto insurance experts.